Will Trump Health Optimism Push DXY into the Range?

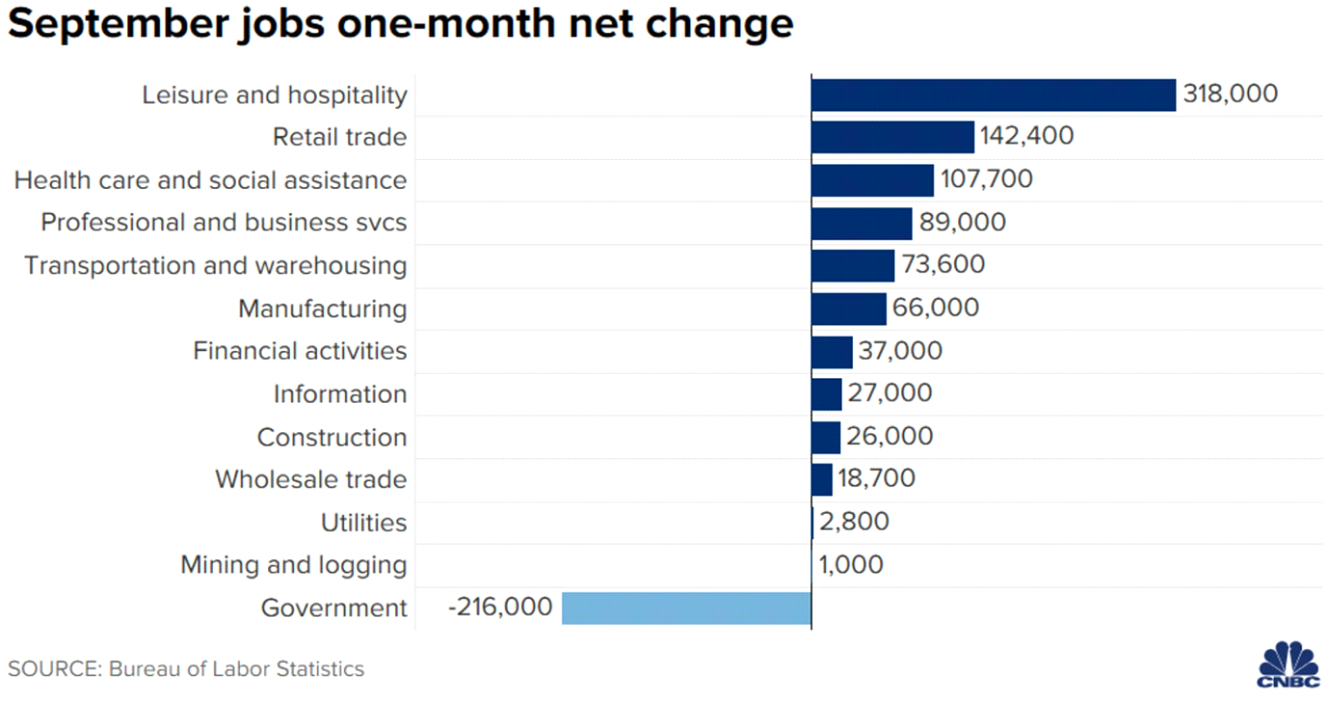

The American economy gained less than expected jobs in September. Payrolls rose by 661K, missing 800K consensus estimate. Sector-by-sector job gains pointed to mediocre performance of jobs market in the last month:

Hotel and retail trade industries were the top hirers. That sectors generate demand primarily for low-skilled labor and known for high turnover and low wage inflation pressures.

Payrolls data was barely able to move markets on Friday as investors turned their focus on Trump’s battle with coronavirus. Despite deterioration and subsequent improvement of the president condition thanks to aggressive treatment, the next few days, according to experts, will be crucial in determining the path of recovery. This implies that markets may be on edge for a first half of the week maintaining range-bound behavior.

Weak labor market data should give more incentive to the Congress to speed up approval of the fiscal deal but spending spree should come no earlier than mid-November. Lawmaking in the United States has been put on pause as October recess kicked in last Saturday, which will last until early November.

Among the positive macro data from the last week, we can note South Korean exports, which rose twice as fast as expected in September - 7.7% YoY against expectations of 3.5%. Imports also accelerated to 1.1%, while Bloomberg economists had expected a 5.1% fall.

Equity markets are recovering amid positive news about Trump’s health while US Dollar support is flagging which is consistent with record high negative correlation between the US currency and stocks, we discussed last week. USD index eyes support at 93.50, which will determine USD plans to sustain bullish rebound:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.