SP500 LDN TRADING UPDATE 30/1/26

SP500 LDN TRADING UPDATE 30/1/26

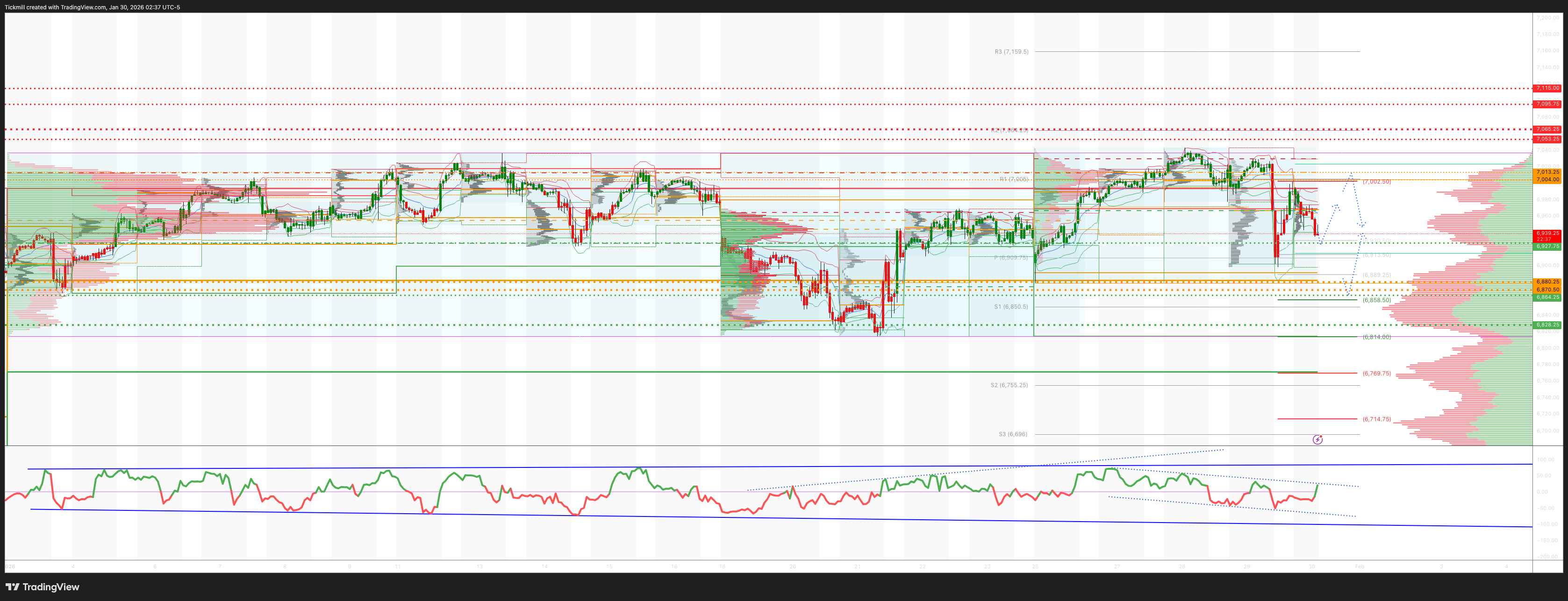

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6880/70

WEEKLY RANGE RES 7065 SUP 6928

FEB OPEX STRADDLE 6726/7154

MAR QOPEX STRADDLE 6466/7203

DEC 2026 OPEX STRADDLE 5889/7779

The Gamma Flip Zone at 6972.75 is crucial; above it, the market experiences “Positive Gamma” with reduced volatility and easier upward movement. Below it, “Negative Gamma” results in erratic price action. Bulls must reclaim this level to stabilise the market.

DAILY VWAP BEARISH 6995

WEEKLY VWAP BEARISH 6961

MONTHLY VWAP BULLISH 6856

DAILY STRUCTURE – BALANCE - 6898/7031

WEEKLY STRUCTURE – BALANCE - TBC

MONTHLY STRUCTURE – ONE TIME FRAMING HIGHER - 6775

DAILY BULL BEAR ZONE 7003/13

DAILY RANGE RES 7053 SUP 6927

2 SIGMA RES 7115 SUP 6864

VIX BULL BEAR ZONE 20

PUT/CALL RATIO 1.17 (The numbers reflect options traded during the current session. A put-call ratio below 0.7 is generally considered bullish, and a put-call ratio above 1.0 is generally considered bearish)

TRADES & TARGETS

PRIMARY PLAY - SHORT ON REJECT/RECLAIM DAILY BULL BEAR ZONE TARGET 6944

LONG ON REJECT/RECLAIM DAILY RANGE SUP TARGET DAILY BULL BEAR ZONE

LONG ON REJECT/RECLAIM WEEKLY RANGE SUP/2 SIG SUP TARGET 6944

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEW - “Risk Off”

S&P closed down 13bps at 6,969 with a MOC of $3bn to BUY. NDX dropped 53bps to 25,884, while R2K edged up 3bps to 2,655, and the Dow gained 11bps to close at 49,072. Trading volume reached 23.11b shares across all US equity exchanges, significantly above the YTD daily average of 18.59b shares. The VIX rose 312bps to 16.86, WTI Crude climbed 332bps to $65.33, the US 10YR Treasury yield dipped 1bp to 4.23%, gold fell 47bps to 5,393, the DXY declined 25bps to 96.20, and Bitcoin dropped sharply by 557bps to $84,293.

Market Sentiment: Risk-Off

Software sector weakness dominated, following disappointing earnings reports:

1. MSFT fell 10% (-$360bn in market cap) due to slower Azure growth (+38% y/y, a deceleration from last quarter) and in-line guidance.

2. NOW dropped 10% despite solid results and guidance, as bearish AI disruption concerns lingered.

3. SAP plunged 13% in Europe on a Cloud backlog miss.

Trading was highly active at the open, with significant two-way flows (heavy supply but also notable defensive buying in spots), normalizing into the afternoon. ETF activity was elevated, accounting for 40% of the tape, with metals representing an outsized portion compared to historical trends.

Software Positioning:

Significant YTD supply and length reductions in the software space have led to record lows in the Software L/S ratio and software's share of our PB book. While this light positioning could theoretically support the sector, price action suggests the market continues to favor thematic tilts (e.g., long AI infrastructure vs. short enterprise SaaS), despite technically stretched levels.

Floor Activity:

Activity levels were rated a 7 out of 10. The floor finished -248bps for sale, compared to a 30-day average of -81bps. Asset Managers were net sellers (~$2b), driven by macro plays and smaller sales in staples, financials, tech, and healthcare. Hedge Funds were net sellers (~$1b), with broad supply across tech and discretionary sectors.

After-Hours Highlights:

- WDC +1% (up 18% this week) after beating and guiding revenues +6% q/q and EPS ~15% above expectations.

- SNDK +11% on guidance for $14 EPS (vs. Street ~$5) and revenues up >50% q/q.

- Visa -2% on a slight beat this quarter (1% volume beat), with unchanged full-year guidance but a softer outlook for the back half of the year.

- AAPL +4% on a significant revenue beat: Q1 Revenue $143.76B vs. Est. $138.4B. Guidance provided during the 5 PM call. Positioning remains low (6.5/10), with the stock largely out-of-favor among institutions due to recent underperformance (-5% YTD, lower for 8 consecutive weeks, and a 14-day RSI at its lowest in over a decade). Debate centers on whether AAPL is a safe haven or faces too many unknowns related to memory and AI.

Derivatives Market:

Equity markets saw significant intraday moves following major tech earnings. MSFT dropped 9.5% (one of its largest single-day declines), and the NDX fell 2% in the morning, nearly realizing the straddle 2x to the downside. Early in the day, there was heightened demand for volatility and skew, with flows focused on monetizing hedges and rolling downside protection, though no signs of panic emerged. VIX futures rose across the board, particularly in February. As markets recovered in the afternoon, volatility eased, led by underperformance in NDX vol, though skew remained elevated. There was renewed interest in GLD/SLV gamma following the precious metals selloff.

Looking Ahead:

Focus shifts to next week's announcement of the new Fed chair. The end-of-week straddle closed at ~60bps.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!