FTSE 100 FINISH LINE 17/12/25

The UK's stock market indexes experienced a rebound on Wednesday, primarily driven by gains in major banks, as inflation figures came in lower than anticipated, bolstering expectations for an interest rate cut by the Bank of England. The FTSE 100, the blue-chip index, climbed 1.5%, on track for its best performance since April 14. After experiencing sharp declines in energy and defence stocks that led the benchmark index to fall on Tuesday, the midcap FTSE 250 index increased by 1%, reaching the highest level in nearly seven weeks.

The annual rate of UK CPI inflation decelerated more than anticipated in November, dropping to an eight-month low of 3.2% from October's 3.6%. This outcome fell below both market expectations, which predicted a decline to 3.5%,. According to the ONS, the decline was widespread across most major categories, largely influenced by earlier and more significant discounting associated with Black Friday. Inflation rates for both services (4.4% y/y) and core components (3.2% y/y) also eased, with the latter marking its lowest level of the year. These trends offer promising signs that underlying inflation is moving in the right direction. Following the data release, market expectations for a December interest rate cut by the Bank of England (BoE) have strengthened, alongside increased market pricing for further rate cuts in 2026.

The FTSE 350 index, which tracks banking stocks, was the frontrunner with a 2.9% rise, achieving its highest level since 2008. HSBC Holdings saw a 3.8% increase, attributed to a brokerage upgrade, while Standard Chartered and Barclays rose by 2.2% and 2.3%, respectively. Energy stocks rebounded by 2.5% after a sharp drop in the previous session, buoyed by soaring oil prices following U.S. President Donald Trump's order for a complete blockade of all sanctioned oil tankers to and from Venezuela. Industrial metal miners also saw significant gains of 2.4%. The day's movements positioned the FTSE 100 for its best year since 2009, rising 20.5% year-to-date, outpacing Wall Street's benchmark S&P 500 index, which has only increased by 15.6% this year. Among individual stocks, outsourcing company Serco's shares surged 5.6%, hitting a decade high after the firm projected profits exceeding analyst expectations for the current year and the next. Conversely, business supplies distributor Bunzl was the top loser on the FTSE 100 index, with a 2.8% drop following the company's forecast of a slight year-over-year decrease in its operating margin for 2026..

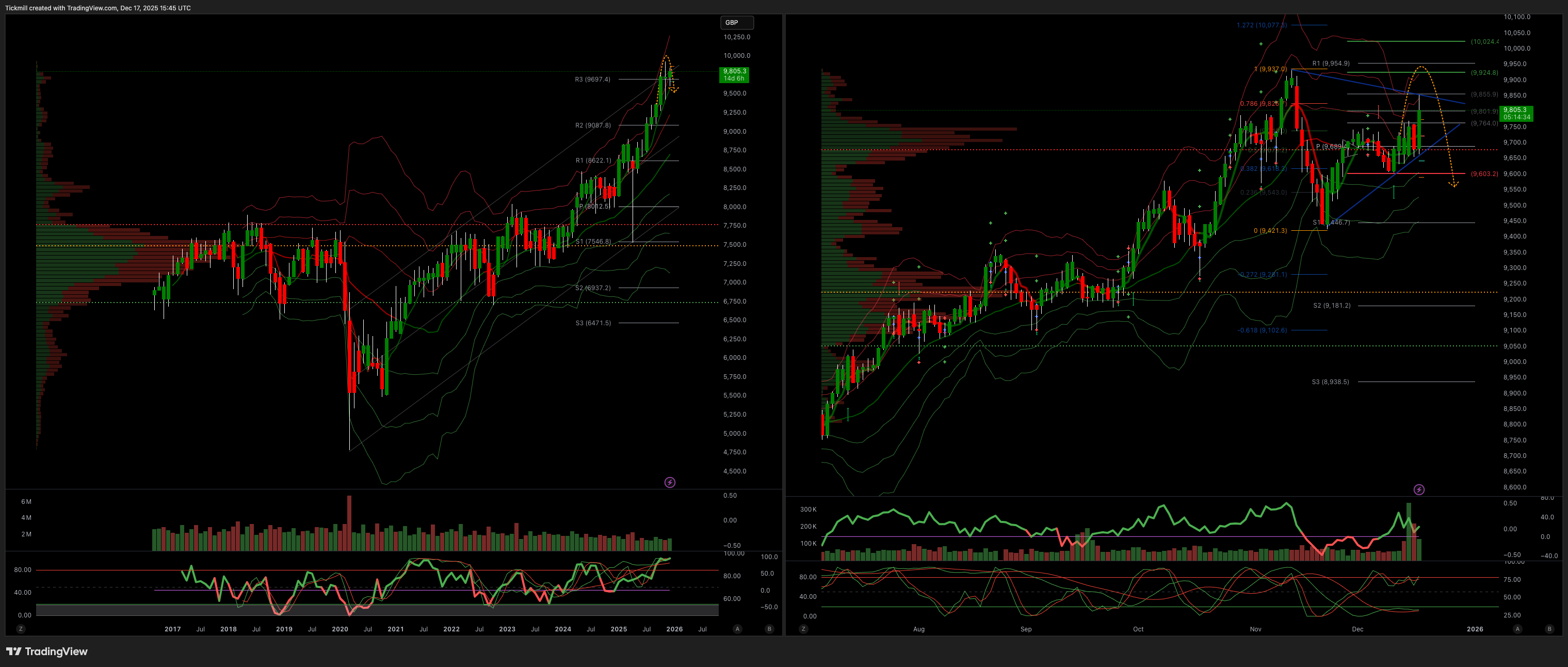

TECHNICAL & TRADE VIEW - FTSE100

Daily VWAP Bullish

Weekly VWAP Bullish

Above 9720 Target 9920

Below 9700 Target 9550

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!