EU’s “Lockdown Calendar” can be the Next Opportunity for Event-based Trading

US elections

Biden is predicted to win Arizona, guaranteeing him moving to the Oval Office despite the withdrawn Pennsylvania votes and the recount initiated there. China, which remained silent for a while after the publication of the voting results, congratulated Biden on his victory today. Potential shocks in the ‘contested elections’ story seem to be finally jumping into background.

Covid-19

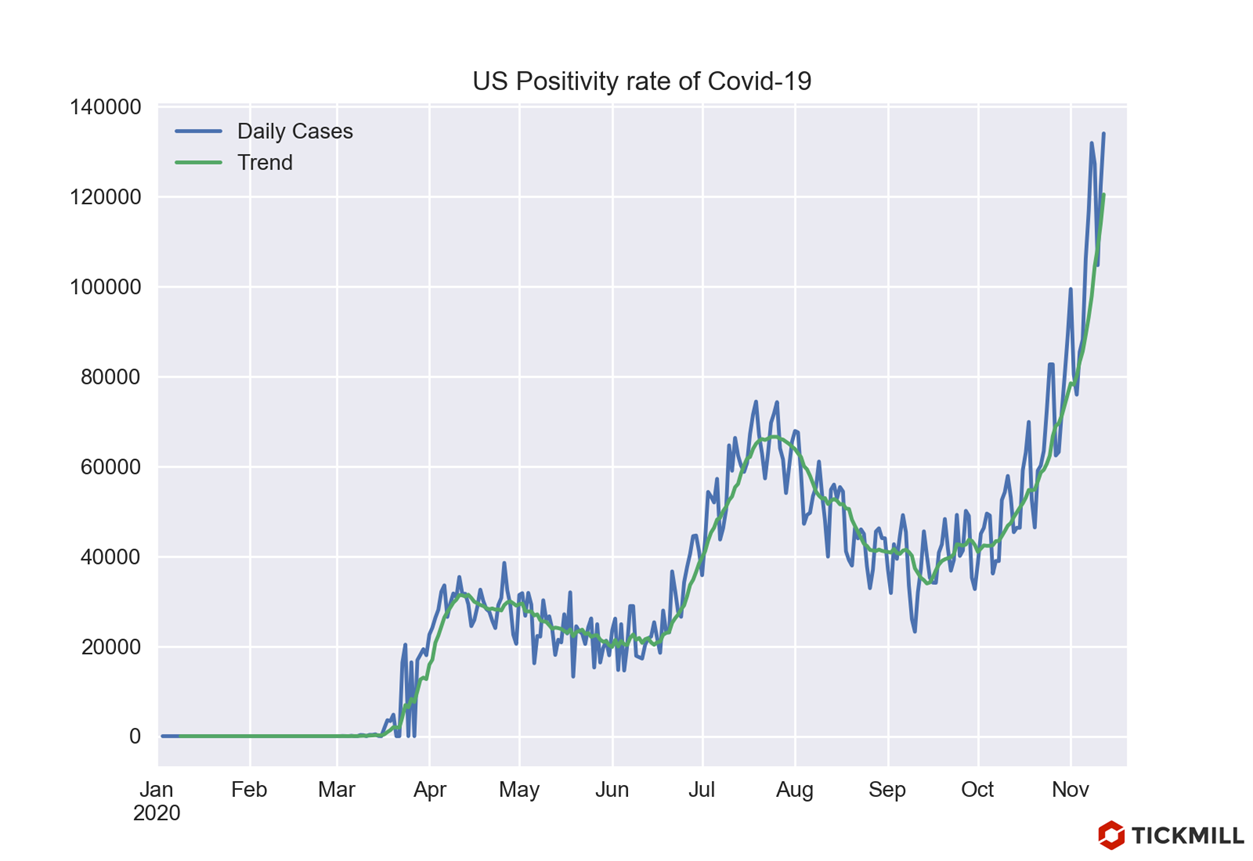

The United States and Europe continue to break records for daily increase in Covid-19 cases. Rapid occupation of hospital beds in certain US states (Chicago, Detroit, California) forced local authorities to tighten restrictions. In the United States, daily growth hit 134K, another all-time high yesterday:

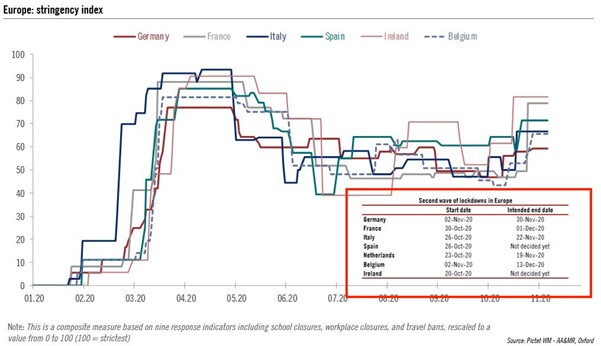

European politicians maintain a "prepare for the worst" stance, continuing to insist that the benefits of lockdowns outweigh the harm. The news about the vaccine breakthrough has not yet affected the timing of the lockdowns. In this regard, the following picture with the timing of lockdowns in European countries may be useful for event-based trading. I think the decision to ease/extend restrictions in those days could be a catalyst for the rise/fall in European markets as we saw it in April:

Speaking of the key economies of the EU - Germany, France, Italy and the Netherlands, the next lockdown decisions are slated for November 30, December 1, November 22 and November 19, respectively.

US economy

Jeremy Powell, at the conference with representatives of other major central banks on Thursday, did not share the market's optimism on the vaccine and urged politicians to agree on a fiscal stimulus.

The bad inflation figures in the US are only delaying the moment when the Fed can start talking about normalizing policy, which can be considered one of the main barriers to a rally in the stock market. Data on Thursday showed that broad inflation slowed to 1.2% in October, while the core (more accurately estimates trends in consumption) dropped to 1.6% (forecast 1.8%). Bond yield bounced down on the data release.

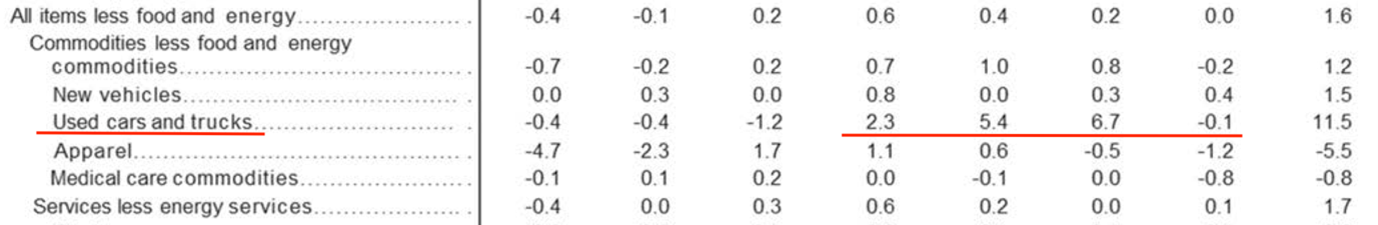

Used car inflation, an indicator of stimulus-fueled consumer boom in the US, which I had previously paid attention to, seemed to have dried up in October. After three months of rapid inflation in July, August and September, this inflation component slowed sharply in October to -0.1%:

Yesterday, Democrats and Republicans in the United States once again did not agree on the “price tag” when discussing the stimulus package, which does not seem to bother markets without signs of an obvious deterioration in the US economy.

The decline in the number of unemployed in the United States, as shown by yesterday's data on unemployment benefits, justify the stance of the GOP. Initial claims amounted to 709K; the number of continuing claims decreased to 6786K. Both indicators were better than the forecast.

The pressure on oil quotes increased as the EIA did not confirm the positive assessment of the API (on commercial oil stocks drawdown in the US), indicating a sharp weekly growth - +4.278 million barrels (forecast - 913K barrels.).

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.