EU yield outlook improves on hawkish ECB, the odds of Fed Pivot grow on dovish retail sales surprise

The key question ahead of today’s ECB policy meeting was whether the bank would opt for a large rate hike with a dovish statement or deliver modest tightening policies while retaining a hawkish stance. The meeting indicated that the ECB leaned in favor of the second option. In its statement, the ECB did not skimp on hawkish language: “interest rates need to be raised further at a steady pace to a sufficiently restrictive level to ensure inflation moves towards a medium-term target of 2%”, and also “keeping interest rates above the neutral level will reduce inflation over time by dampening demand, and also guard against the risk of a persistent upward shift in inflation expectations.”

In terms of reducing the ECB's bond holdings, redemption bond reinvestment under the Asset Purchase Program (APP) will decline to an average of 15 billion euros per month until the end of the second quarter of 2023, and its subsequent pace will be determined as the process progresses.

The ECB has also released updated staff economic projections. The regulator expects inflation to fall to 3.4% in 2024 and 2.3% in 2025. The figure for 2024 has been significantly revised upwards. At the same time, the ECB expects only a short and shallow recession, forecasting a eurozone growth of 0.5% in 2023 and 1.9% in 2024. This is slightly less optimistic than the previous forecast, but there is no noticeable anxiety about recession.

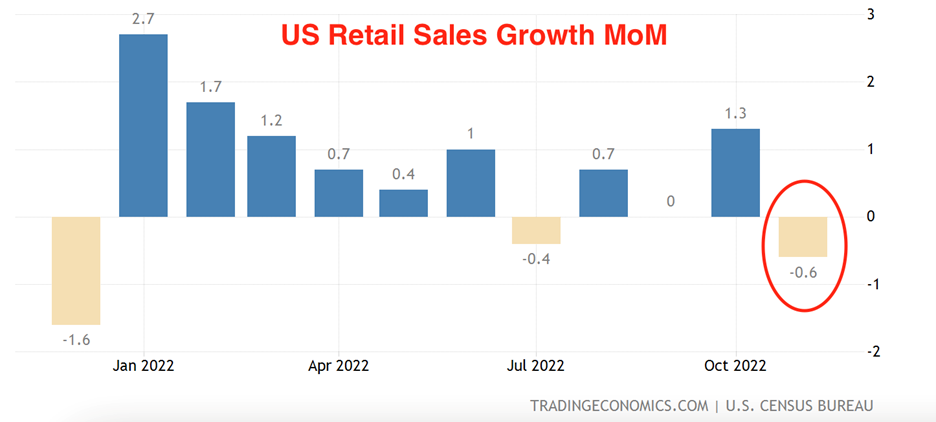

EURUSD moved up amid hawkish statements from the European regulator, the dollar also further weakened on a negative surprise in US retail sales data (-0.6% MoM, -0.1% forecast):

Together with a faster slowdown in US inflation in November, a weak retail sales report fueled markets' fears of an impending downturn in the US economy, which spooked investors in risk assets. Major US stock indexes fell by about 1.5%.

Based on the outcomes of the meetings of the Fed and the ECB, it seems that the ECB is becoming more decisive in the fight against inflation, while the risks of a pause from the Fed started to increase, especially against the backdrop of weak incoming data in the key US consumer sector. There is still little the ECB can do to reduce actual inflation, but it can help re-anchor inflation expectations. With today's announcement, it's clear that the ECB wants to use interest rates fully as its primary inflation-fighting tool first, and that balance sheet shrinkage remains on the back burner. With growth prospects still relatively optimistic, there is a growing risk that the ECB will push the eurozone economy further into recession with each new interest rate hike. Nevertheless, in the short term, the Euro becomes a more attractive choice on expectations of a narrowing yield differential, so the EURUSD pair is likely to continue to rise for some time.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.