Divided US Government: Big Bullish Factor for US Stocks?

European equity markets, following Asian gains, surged on Thursday, cheering firming Biden's lead in the presidential elections. SPX futures advanced towards 3500 points after choppy price action on Wednesday, the highest since mid-October. To turn the tables, at least three key swing states have to flip red, which is a long shot as most of the votes have been counted indicating that almost all key states are leaning in favor of Biden.

Despite this, the risk of lengthy legal battles remains high. In some key swing states, Biden's advantage is less than 1%, and the US law allows for the initiation of recount process in this case.

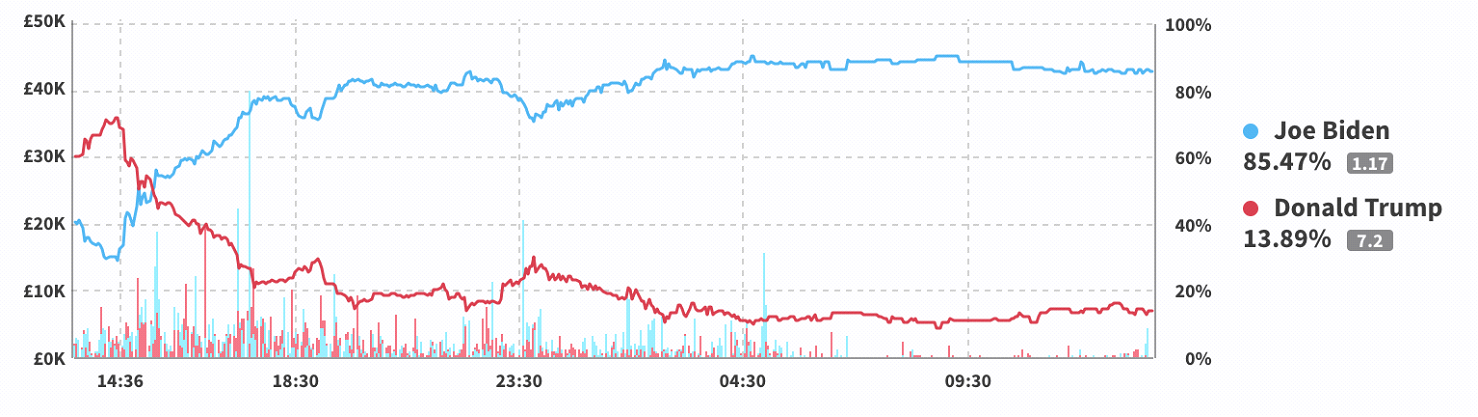

At the time of writing of this article, the probability distribution of a win of each candidate in betting markets is as follows:

Source: smarkets.com

In four key swing states - Pennsylvania (20 electoral votes), Georgia (16 votes), Arizona (11 votes), and Nevada (6 votes), Biden's victory is currently estimated at 77.52%, 63.69%, 75.19%, and 85.47% respectively.

The outcome, where Biden is the president while GOP retains majority in Senate ("divided Congress") is particularly benign for tech shares (and equity market as a whole) since it would eliminate two major risks at once:

- Trade wars, as Biden is seen as favoring less confrontational approach with foreign partners;

- Corporate tax hike, which would be possible only in case of Democratic sweep outcome.

In other words, with divided government outcome probability of radical changes in policy decreases which is a big factor of certainty. And equity markets love certainty.

This could also explain why tech shares took over the lead in the US equity market in recent days. Since the start of November, Nasdaq has rallied by 9% while SPX and DOW have gained about 6%:

On the data side, ADP estimated job growth at 365K in October, well below the 650K forecast. ISM US activity indices were broadly in line with expectations.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.