Buyers Ditch Russian Oil on Growing Sanctions Risk

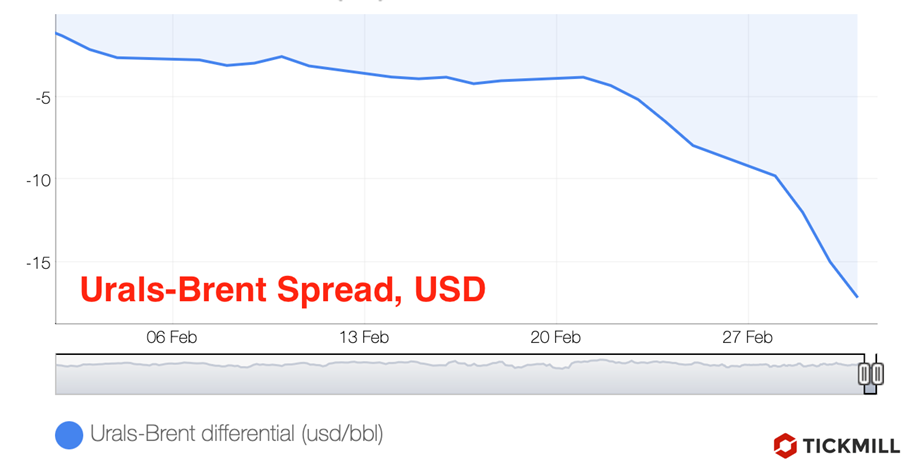

Oil prices hit a new high today - $116.50/bbl for WTI and $119.70/bbl for Brent. The last time the market saw such prices was in October 2008. The Ukrainian conflict is increasingly affecting oil exports from Russia, but surprisingly, this is not a result of sanctions targeting oil production or exports. Refineries reduced demand for Russian oil anticipating issues in making payments and disruptions of supplies. This is reflected in dynamics of the Brent price premium for Urals, which accelerated increase starting from February 24. In early March, buyers were ready to overpay $18 for a barrel of Brent:

Declining demand for Urals is offset by rising demand for Brent, making it difficult for world oil prices to pull back despite extremely steep rise (16%) since the beginning of March.

Sanctions pressure on Russia will continue to affect the oil market, given the country's role in oil production and export (third and second place respectively). At the same time, 53% of oil exports from Russia go to Europe, so the main risks of cost-push inflation due to disruptions of supplies are concentrated here. The reduction in oil supplies from Russia is estimated at 2 million b/d in the coming months.

There are two factors that could contain rise in oil prices:

- the de-escalation of the conflict in Ukraine;

- the Iranian nuclear deal, which will allow Iran to partially replace Russia in the oil market.

On the first point, information will appear today, when the details of the second round of negotiations between Russia and Ukraine will be released.

OPEC+ at the last meeting actually took the side of the Russian Federation, stating that the high oil price reflects geopolitical risks, and not an imbalance in supply and demand, so the participants will not aggressively increase production. Prices reacted upwards as supply pledges clearly underperformed expectations. Oil importing countries are trying to coordinate efforts to use strategic reserves to stabilize prices, but they will not last long. A technical oil rebound without Iran returning to the market or without a quick de-escalation appears to be on hold.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.